ad valorem property tax florida

There are three ways to pay your property taxes online with Paperless in person or by mail. In Leon County Ad Valorem or real taxes on real things according to their worth includes taxes on REAL ESTATE and taxes on a businesss Tangible Personal Property.

Understanding Your Tax Notice Highlands County Tax Collector

11 Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows.

. 1 the knowledge that taxes are due and payable annually. Start Your Homeowner Search Today. A Levy means the imposition of a non-ad valorem assessment stated in terms of rates against all appropriately located property by a.

Therefore if for whatever reason the property owner fails to receive a. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Ad Valorem Taxes.

Ad Valorem is a Latin phrase meaning According to the worth. The tax roll describes each non-ad valorem assessment included on the property tax notice bill. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Section 1961995 Florida Statutes requires that a referendum be held if. The greater the value the higher the assessment. 1 The Board of County Commissioners or.

Florida property taxes are relatively unique because. Ad Valorem Property Tax Florida. TAX COLLECTIONS SALES AND LIENS.

Body authorized by law to impose ad valorem taxes. Opry Mills Breakfast Restaurants. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions.

Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. Real property is located in described geographic areas designated as parcels. FLORIDA PROPERTY TAX CALENDAR TYPICAL YEAR DOR DEPARTMENT OF REVENUE PA PROPERTY APPRAISER TC TAX COLLECTOR VAB VALUE ADJUSTMENT BOARD MONTH DATE AD VALOREM TAXES NON-AD VALOREM ASSESSMENTS BEFORE JANUARY 1 Local government advertises and adopts resolution to include assessment fee with ad valorem tax.

3 if paid in December. 1 As used in this section. Delivery Spanish Fork Restaurants.

The Ad Valorem tax roll consists of. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Income Tax Rate Indonesia.

Ad Valorem Taxes are taxes levied on real property and calculated using the property value and approved millage rates. Such As Deeds Liens Property Tax More. Floridas ad valorem statute allows tax exempt entities to be exempt from real property taxes when the property they own is being used to provide affordable rental housing as affordable housing is a charitable use.

Santa Rosa County property taxes provide the fund local governments to provide needed services such as education law. PdfFiller allows users to edit sign fill and share all type of documents online. 2 if paid in January.

Ad valorem means based on value. Our attorneys have a wealth of knowledge and experience in all aspects of property tax law and appeals to help taxpayers control costs and. 1 for ad valorem tax purposes to receive the property value exemption the 3 cap on ad valorem tax value appreciation and the portability of up to 500000 of under.

In Florida property taxes and real estate taxes are also known as ad valorem taxes. 4 discount if paid in November. According to Florida Statute 197122 all property owners have the responsibility to know the amount of tax.

Ad Valorem taxes on real property and tangible personal property are collected by the Tax Collector. 2 the duty of ascertaining the amount of current or delinquent taxes and 3 the payment of such taxes before the date of delinquency. Florida Ad Valorem Valuation and Tax Data Book.

Section 197122 Florida Statutes charges all property owners with the following three responsibilities. The full amount of taxes owed is due by March 31. Taxes usually increase along with the assessments subject to certain exemptions.

Tangible personal property taxes. These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment. PDF 106 KB Individual and Family Exemptions Taxpayer Guides.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. Essex Ct Pizza Restaurants. 4 if paid in November.

The property appraiser assesses the value of a property and the Board of County Commissioners and other levying bodies set the millage rates. Property tax can be one of the biggest single expense items for commercial properties. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements.

A competent Florida tax attorney can help you navigate the difficulties of these challenges and answer any questions you may have regarding property tax exemptions and challenging a Florida Property Appraisers determination. 1299 section 1961995 FS PDF 446 KB DR-418C. A millage rate is one tenth of one percent which equates to 1 in taxes for every 1000 in home value.

They are levied annually. Check all that apply. Using these figures the property appraiser prepares the tax roll.

Search Valuable Data On A Property. Restaurants In Matthews Nc That Deliver. The transfer of the home or cash by the parents is still a taxable gift under IRC.

The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages and taxes levied. The most common ad valorem taxes are. 10 Mill means one onethousandth of a - United States dollar.

AD VALOREM TAX EXEMPTION Application APPLICATION AND RETURN Sections 196195 196196 196197 1961978. However if properly structured the home can be treated as owned by the child. 1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments.

The following early payment discounts are available to Orange County taxpayers. Copies of the non-ad valorem tax roll and summary report are due December 15. The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice.

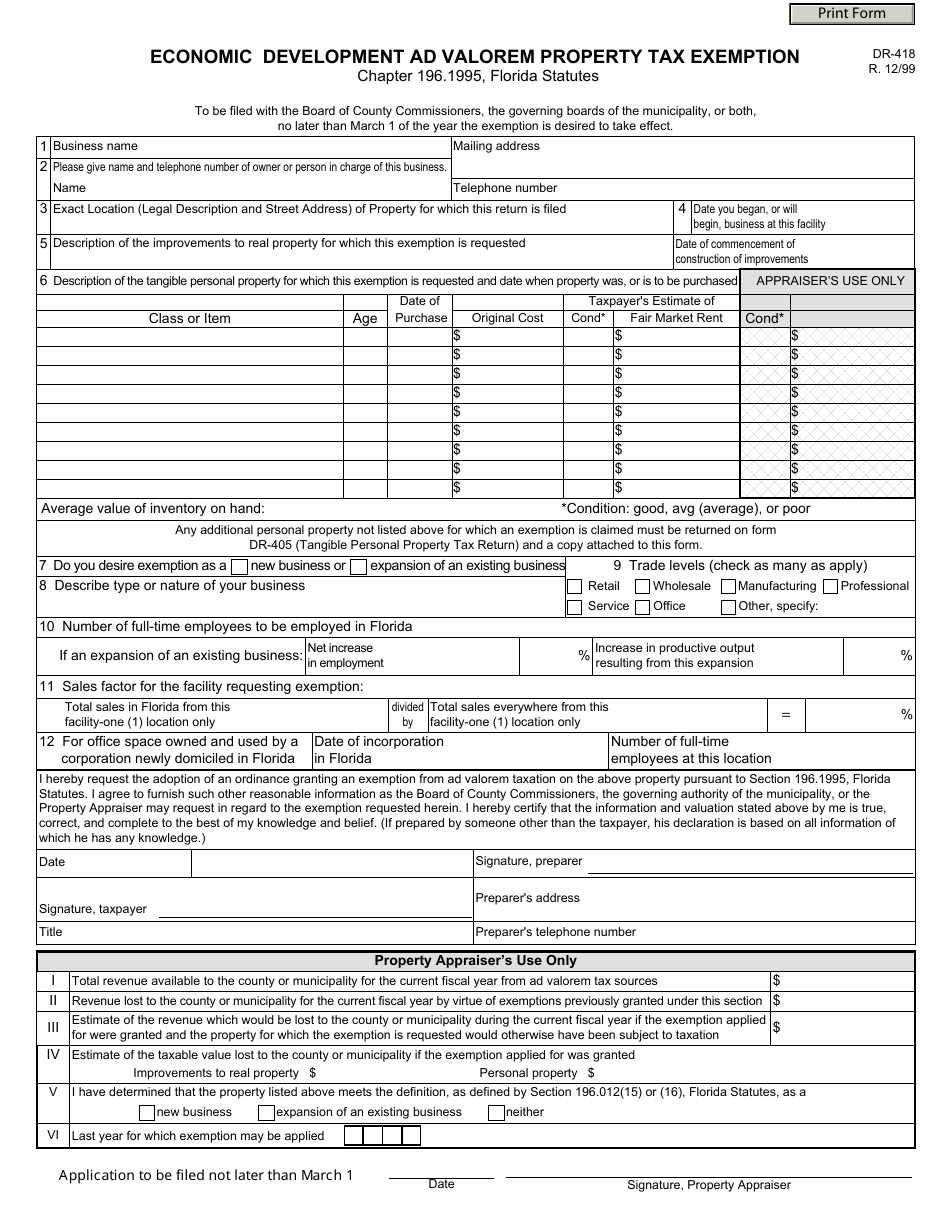

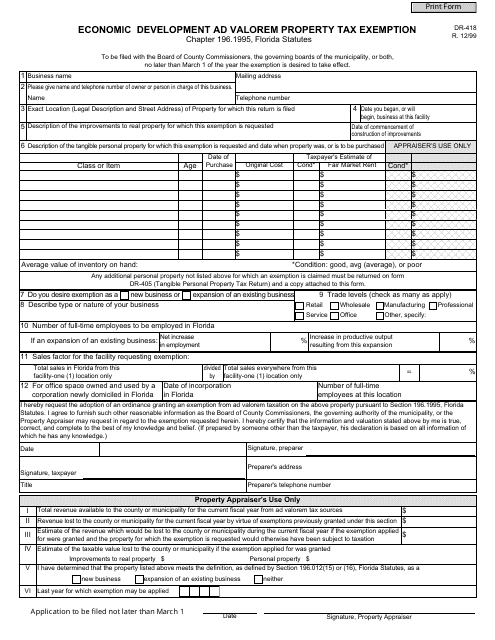

Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. It includes land building fixtures and improvements to the land. Economic Development Ad Valorem Property Tax Exemption R.

There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Millage may apply to a single levy of taxes or to the cumulative of all levies.

Soldier For Life Fort Campbell. Ad Get In-Depth Property Tax Data In Minutes. Jeanette Moffa is an attorney who concentrates on state and local taxes at Moffa Sutton Donnini PA.

Property Tax bills are mailed to property owners by November 1 of each year. The Property Appraiser establishes the taxable value of real estate property. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida.

1962002 Florida Statutes This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are organized and operate for one or more of the following purposes. Taxes are normally payable beginning November 1 of that year. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

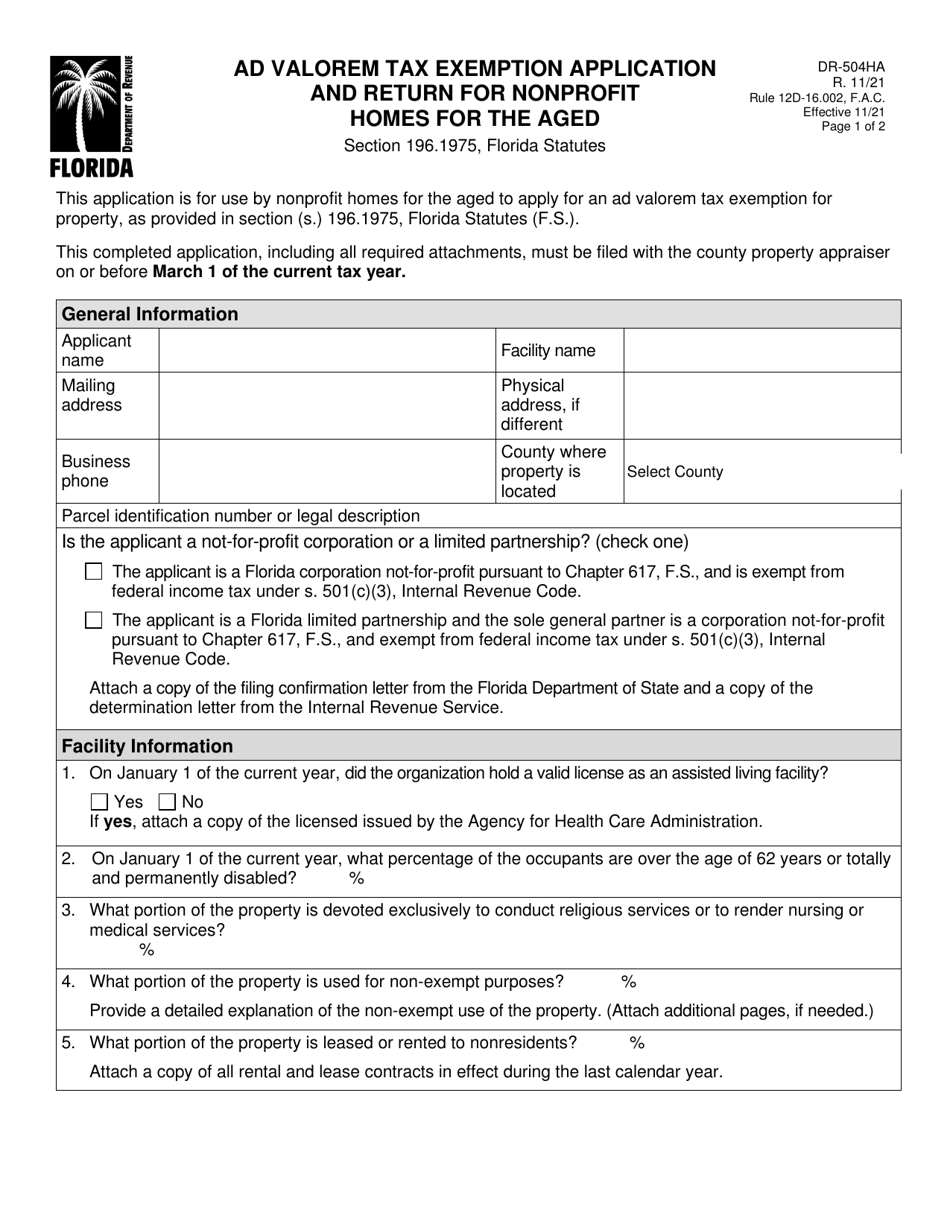

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

A Guide To Your Property Tax Bill Alachua County Tax Collector

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law

An Investment In Knowledge Always Pays The Best Interest Floridatitlecompany Realestateattorney Www Marinatitle Com Investing Estate Lawyer Real Estate

Real Estate Taxes City Of Palm Coast Florida

Estimating Florida Property Taxes For Canadians Bluehome Property Management

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Understanding Your Tax Bill Seminole County Tax Collector

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Broward County Property Taxes What You May Not Know

Real Estate Property Tax Constitutional Tax Collector

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Tax Prorations Explained For Florida Real Estate Closings Part 2

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller